Other Pages

- Opinion Poll

- About Us

- Send Your Story

- Contact Us

- Newsletter

- Privacy Policy

- Terms and Conditions

GTBank's e-commerce and quick credit businesses are in the spotlight as Central Bank of Nigeria (CBN) issued an approval-in-principle to the lender for its plan to become a Holding Company. This comes a month after Sterling Bank obtained theirs in order to branch out of the core banking business.

The Holding Company status will lead to the restructuring of GTBank, enabling the lender to establish standalone companies that will be under the Holding Company. GTBank's decision to take this path is prompted by the competitive nature of Nigeria's financial sector.

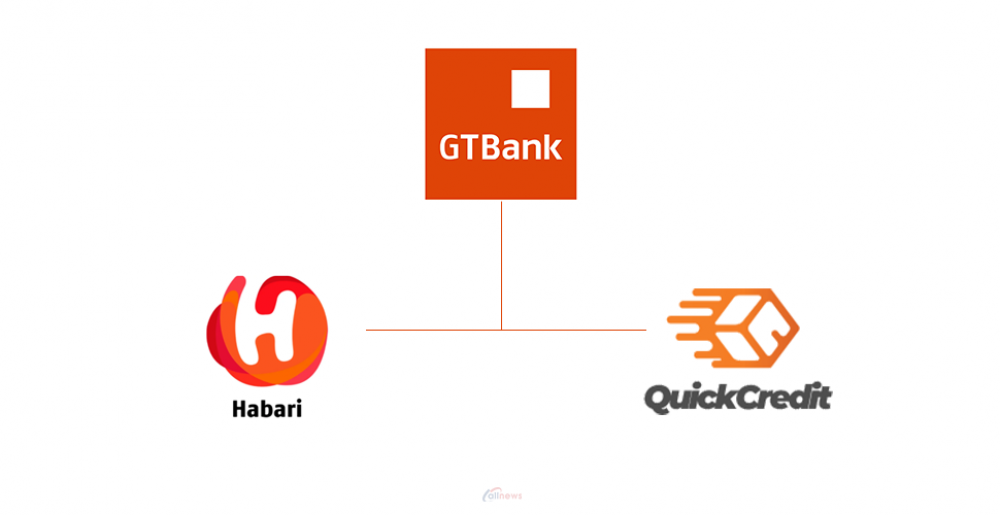

In a statement seen by AllNews, GTBank said the Holding Company status will make it flexible to adapt to future business opportunities - note that GTBank has invested in some small business opportunities such as Habari (an online marketplace) and its Quick Credit service which is one of the most used credit sources due to its cheap interest rate.

READ ALSO: How Police Killed Dangote Refinery Worker During Company Protest

The Habari platform is also in competition with UBA's Marketplace. Habari is a multipurpose platform, but with a focus on e-commerce, pitting it against major names in the e-commerce market like Jumia and Konga - during the Social Media Week this year, GTBank's Managing Director, Segun Agbaje, said Habari is quickly gaining ground among online users.

The GTBank Quick Credit was designed to compete with Fintech platforms like Eyowo, Zedvance, Palmcredit, Renmoney, Specta, Carbon, Branch, and more offering credit to the underserved population of the country.

GTBank's Quick Credit and Habari are expected to gain from the Holding Company structure, as it will enable the company to focus on the e-commerce and quick credit markets.

Aside from the CBN approval, the bank also got a "No-objection" from the Securities and Exchange Commission (SEC). The approval-in-principle means GTBank can now commence the restructuring of the organisation, which will make the Holding Company the parent company of GTBank.

"Guaranty Trust Bank Plc (GTBank or the Bank) is pleased to announce it has obtained the approval-in-principle of the Central Bank of Nigeria (the CBN) to commence the formal process of the reorganisation of the Bank to a financial holding company (the Restructuring), which will be implemented by means of a scheme of arrangement between the Bank and its shareholders pursuant to the Companies and Allied Matters Act (the Scheme).

"The Bank has also obtained the "No-objection" of the Securties & Exchange Commission (the SEC) in connection with the proposed Scheme." GTBank disclosed in the statement obtained by AllNews.

According to the statement, "Under the Restructuring, it is proposed that the issued shares in the Bank be exchanged or a one-for-one basis for the shares in a financial holding company. The Bank's existing Global Depositary Receipts (GDRs) are also proposed to be exchanged or a one-for-one basis for new GDRs to be issued by the financial holding company.

READ ALSO: Financial Crisis: Ikeja Hotel Set To Lose N4.63billion Over Faceoff With Lagos State

"The Board of Directors of GTBank made the decision to embark on the Restructuring following a comprehensive strategic evaluation of the operating and competitive environment of the Nigerian banking sector in the near term. The Board expects that the financial holding Company will have greater strategic flexibility to adapt to future business opportunities as well as market and regulatory changes than is currently the case.

"Subject to the approval of the Scheme by the Bank's shareholders the relevant regulatory authorities and the Federal High Court of Nigeria, the holding company will have an organisational structure similar to that used by a significant number of major financial institutions globally." the statement reads.

AllNews had reported that Sterling Bank is planning to undergo restructuring after receiving approval in principle from the CBN to form a Holding Company. The announcement was made by Sterling Bank's Chief Executive Officer, Abubakar Suleiman.

Sterling Bank requested permission to become a Holding Company in order to make its Non-Interest Banking an autonomous entity. AllNews gathered from a statement obtained that the Holding Company license will enable Sterling Bank's Non-Interest Bank and other non-core businesses to have their own management focus.

0 Comment(s)